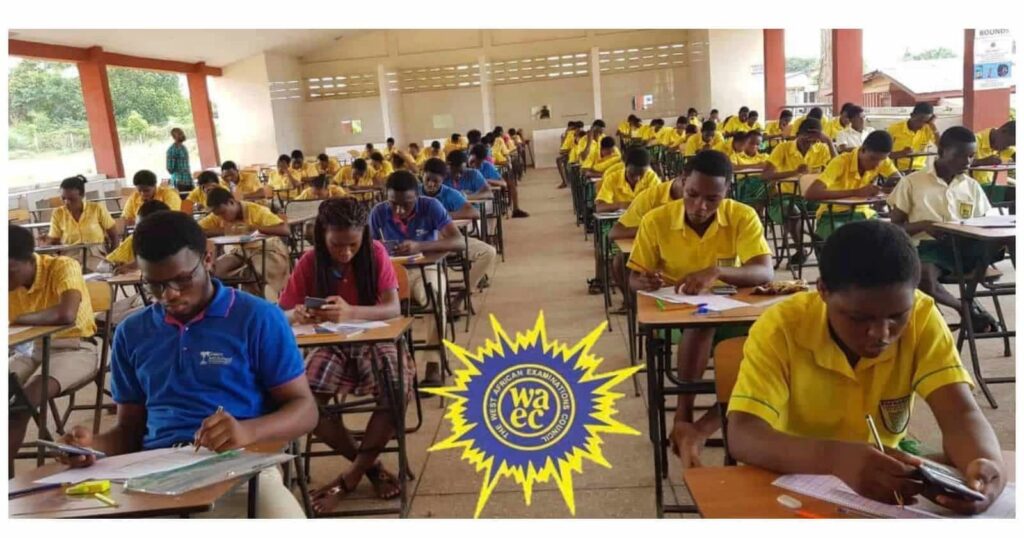

WAEC Financial Accounting Syllabus 2025/2026

WAEC Financial Accounting Syllabus 2025/2026: Hi there! If financial accounting is one of your registered subjects and you are preparing for the WAEC exams, don’t miss this article. The official WAEC Financial Accounting syllabus will be shared in this article, and for the following reasons, we advise you to adhere to it: The syllabus serves as a guide that outlines the precise subjects you must study for your impending tests.

- II. It guarantees that you don’t overlook anything crucial and assists you in knowing what subjects to concentrate on.

- You should see this syllabus as a secret weapon given to you free of charge.

- We can guarantee that you will ace your exam if you put in the necessary effort and study.

PURPOSE AND GOALS

The purpose of this subject’s exam is to evaluate applicants:

- (a) knowledge of accounting concepts and how accounting records business transactions;

- (b) understanding and putting into practice the principles and operations of accounting as they relate to organizations; (c) laying the groundwork for future accounting research.

- The examination’s schedule

Two papers, Paper 1 and Paper 2, will be submitted in one sitting as a composite.

Paper 1 will consist of fifty multiple-choice questions that must all be answered in one hour in order to receive 25 points.

PAPER 2: Will be made up of two sections, Sections A and B and will last 2½ hours.

Section A: Will contain four essay questions on Theory of Financial Accounting.

READ ALSO:WAEC Registration 2025/2026 Fees, Deadlines, Expos & Secrets No One told You

WAEC SYLLABUS FOR FINANCIAL ACCOUNTING | ||

| SN | TOPICS* | OBJECTIVES |

| 1 | THEME | |

| Introduction to Financial Accounting | 1.1 History, nature and functions of Accounting. 1.2 Users of Accounting information. 1.3 Stages in the Accounting process. 1.4 Characteristics of Accounting information. | |

| 2 | The Accounting Equation and Double Entry Principles,*,,,,,** | 2.1 Accounting Equation. 2.2 Purpose and functions of source documents. 2.3 Subsidiary books. 2.4 The ledger: classification of Accounts. 2.5 Cash Book: analytical cash book, including petty cash book. 2.6 Preparation of Trial Balance. 2.7 Bank Reconciliation Statements. 2.8 Correction of errors and Suspense Account. |

| 3 | Accounting Concepts | 3.1 Meaning. 3.2 Types. 3.3 Significance. 3.4 Limitations. |

| 4 | The Final Accounts of a Sole Trader/proprietorship | 4.1 Trading, profit and loss accounts/Income statement. 4.2 Balance sheet/statement of financial position. 4.3 Adjustments to final accounts. |

| 5 | Provisions and Reserves | 5.1 Provision for doubtful debts/Allowance for doubtful debts. 5.2 Provision for discounts. 5.3 Depreciation – concepts, reasons for recording and methods: (i) straight line; (ii) reducing balance; (iii) sum of the years digits; (iv) revaluation. 5.4 Accounting for depreciation. 5.5 Reserves – revenue and capital reserves. |

| 6 | Manufacturing Accounts | 6.1 Purpose of Manufacturing Accounts. 6.2 Cost classification in Manufacturing Accounts. 6.3 Preparation of final Accounts of Manufacturing concern. |

| 7 | Control Accounts and Self- balancing Ledgers | 7.1 Meaning and uses of control accounts 7.2 Types: (i) sales ledger control (ii) purchases ledger control 7.3 Preparation of Control Accounts 7.4 Reconciliation of Control Accounts |

| 8 | Single Entry and Incomplete Records | 8.1 Meaning and limitations 8.2 Computation of profit or loss from opening and closing balance sheets. 8.3 Conversion of singe entry to double entry. 8.4 Preparation of final accounts from a set of incomplete records. 8.5 Mark up and Margin |

| 9 | Accounts of Not-for-Profit Making Organizations | 9.1 Meaning and terminologies. 9.2 Receipts and payments accounts. 9.3 Subscriptions Account 9.4. Income and expenditure accounts. 9.5 Accumulated fund. 9.6 Balance sheet. 9.7 Profit or loss from income generating activities. |

| 10 | Partnership Accounts | 10.1 Nature and formation of partnership. 10.2 Partnership agreements/Deed. 10.3 Profit and loss appropriation accounts. 10.4 Partners capital account and balance sheet 10.5 Admission of a new partner. 10.6 Treatment of goodwill and revaluation of assets 10.7 Dissolution of partnership (Questions will not be set on Garner V. Murray and piecemeal realization) |

| 11 | Company Accounts | 11.1 Nature and formation of a company. 11.2 Types of companies and shares. 11.3 Issue of shares. 11.4 Loan capital, debentures/loan notes and mortgages. 11.5 Final accounts of company for internal use only. 11.6 Interpretation of accounts using simple ratios. 11.7 Purchase of business account. * 11.8 Statement of Cash Flow (using direct and indirect methods). NOTE: Separate questions may be set to meet statutory requirements of individual countries. Candidates’ answers must meet statutory requirements of individual countries. |

| 12 | Accounting for Value Added Tax | 12.1 Purpose of VAT. 12.2 Characteristics of VAT. 12.3 Bases of computing input/output VAT. 12.4 Preparation of VAT returns. 12.5 Exempt goods and services . |

| 13 | Departmental and Branch Accounts | 13.1 Meaning and importance 13.2 Differences between a department and branch. 13.3 Preparation of departmental account. 13.4 Preparation of Branch Account excluding foreign branches. 13.5 Inter branch transactions. |

| 14 | Public Sector Accounting | 14.1 Meaning and difference between Public Sector and Private Sector Accounts. 14.2 Sources of public revenue. 14.3 Capital and recurrent expenditures. 14.4 Preparation of simple government accounts. |

| 15 | Information Technology in Accounting | 15.1 Manual and computerized Accounting Processing Systems. 15.2 Processes involved in data processing. 15.3 Computer Hardware and Software. 15.4 Merits and demerits of manual and computerized accounting processing systems. |

| 16 | Miscellaneous Accounts | 16.1 Meaning, introduction, terminologies and preparation of simple: (i) Joint Venture Accounts (ii) Consignment Accounts (iii) Contract Accounts (iv) Hire Purchase Accounts |

| 17 | Financial system | 17.1 Meaning and components. 17.2 Meaning, functions and features of: (i) money market; (ii) capital market; (iii) insurance market. 17.3 Methods of raising funds from the capital market: (i) offer for sale; (ii) offer for subscription; (iii) rights issue; (iv) private placement; 17.4 Requirements for accessing the capital market. 17.5 Benefits of capital market to: (i) investors; (ii) government; (iii) economy; (iv) individual company; 17.6 Types, features and reasons for regulation. |

WAEC Financial Accounting Recommended Textbooks 2025/2026

| S/N | Title | Author(s) |

|---|---|---|

| 1 | Business Accounting Volume 1 – West African Edition | Frank Wood and Omunya |

| 2 | Business Accounting Volume 2 | Frank Wood |

| 3 | Accounting and Finance | Frank Wood |

| 4 | Foundation Accounting | A. H. Millchamp |

| 5 | Basic Accounting | J. D. Magee |

| 6 | Accounting for Senior Secondary School | S. C. Malhorta, P. K. Botchweyand, P. A. Amankwah |

| 7 | Accounting in Business | R. J. Bull |

| 8 | Company Accounts | J. N. Amorin |

| 9 | Principles of Accounting | K. B. Appiah Mensah |

| 10 | Incorporated Private Partnership Act 1962, Act 152 | – |